Is there some place that tracks the balances of un-applied prepaid invoices. That is, it retains an asset corresponding to the amount of unused prepayment at a given moment, records the expense in the proper period, and keeps the bank rec in the loop.Īre there any issues here that I might be unaware of? Something I could not find in my research was the impact of constantly applying zero to the prepayment in the invoice entry step. In the distribution Line tab, I credit the above Prepaid Expense asset account and debit related expense account for the portion of the expense incurred that period.

I also choose zero for the total invoice amount.ģ.

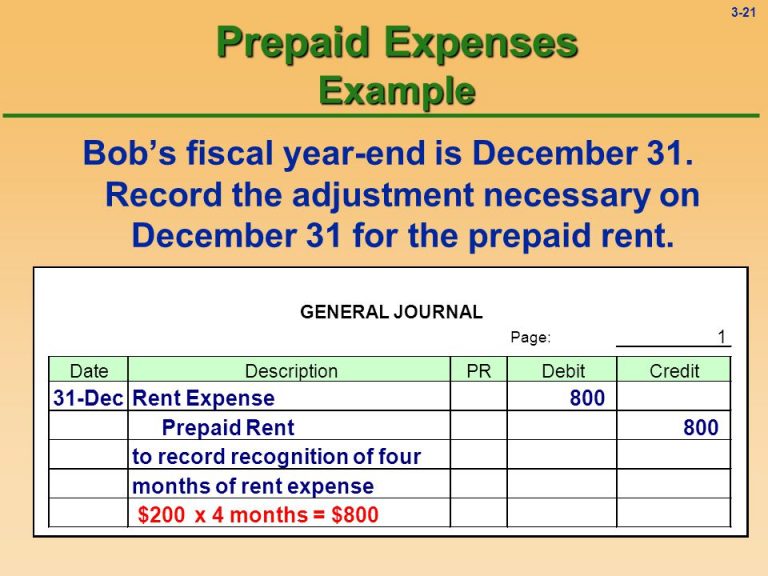

I enter in a new invoice number and choose the Prepaid Invoice from the above "Recording Prepayment" step, but I choose zero for the amount to be applied. (This would be a recurring invoice with the distribution preset)Ģ. When in the period that a portion of the expense is incurred, I create an invoice in the AP Invoice Entry tool. Note: For the GL distribution I choose a Prepaid Expense asset account for the distribution.ġ. Recording Prepayment:(link to the sage partners "record a prepayment" instructions) The process is pretty standard except for when I record the expense as it is incurred.

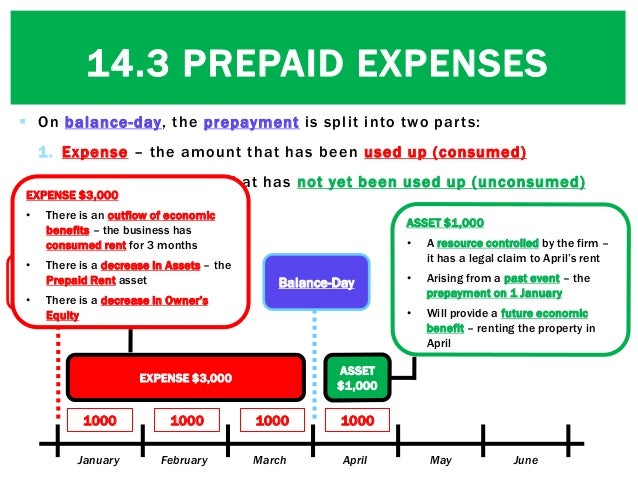

The expenses related to this payment will be incurred next fiscal year and broken up quarterly. Prepaid expenses are usually minuscule in relative size and rarely have a significant impact on a company’s valuation - hence, prepaid expenses are often aggregated with the “Other Current Assets” line.I have done some research using the SAGE 100 ERP built in help center, this community, and general google searches and it appears that the following process would work for recording a prepaid expense. However, if the connection between prepaid expenses and OpEx is unclear, the projection of prepaid expenses can be linked to revenue growth as a simplification. Prepaid expenses are typically modeled to be tied to operating expenses (OpEx). Forecasting Prepaid Expenses in Financial Models Monthly Expense on Income Statement = $2,000īy the end of the twelve-month coverage period, the entire insurance benefits are delivered, the total expenditure was expensed, and the corresponding prepaid expense asset on the balance sheet declines to zero.In the coming twelve months, the company recognizes an expense of $2,000/month - which causes the prepaid expense asset on the balance sheet to decrease by $2,000 per month. If the company makes a one-time payment of $24,000 for an insurance policy with twelve-month coverage, it would record a prepaid expense of $24,000 on the initial date. Here, we’ll assume that a company has paid for insurance coverage in advance due to the incentives offered by the provider. One frequent example of prepaid expenses is insurance coverage, which is often paid upfront to cover multiple future periods. This means that even though the expense has been paid. In contrast, accrued expenses are costs incurred by a company but not yet paid for, typically due to the absence of an invoice (i.e. A prepaid expense is initially recorded as an asset in a companys accounting books and balance sheet. One notable difference between prepaid expenses and accrued expenses is the treatment on the balance sheet:įurthermore, the prepaid expense line item stems from a company paying in advance for products/services anticipated to be used at a later date. Simultaneously, as prepaid expenses decrease, the expenses appear on the income statement in the period corresponding with the coinciding benefit. Once the benefits of the assets are gradually realized, the prepaid expense is reduced as the asset is expensed on the income statement.Ĭomparable to the mechanics of a depreciation and amortization schedule, the prepaid expense asset incrementally declines until the balance eventually reaches zero. Since prepaid expenses are categorized as “current” assets, the benefits associated with the products or services paid for upfront are expected to be used within the next twelve months. the realization of benefits by the customer). The prepaid expense is listed within the current assets section of the balance sheet until full consumption (i.e. Prepaid expenses represent future expenses paid in advance - so, until the associated benefits are realized, the expense remains a current asset. Prepaid Expense Schedule - Accounting Treatment Under the matching principles of accrual accounting, revenue and expenses must be recognized in the same period. If a company decides to pay for a product or service in advance, the upfront payment is recorded as a “prepaid expense” in the current assets section of the balance sheet. How do prepaid expenses compare to deferred revenue?.Why might a company pay for an expense in advance?.Are prepaid expenses treated as an asset or liability on the balance sheet?.What is the definition of a prepaid expense?.

0 kommentar(er)

0 kommentar(er)